<-

Back to all articles

Market

Sequoia or A16z? Whose portfolio companies are growing faster in the current AI boom?

Apr 26, 2024

Andreessen Horowitz (A16z), Khosla Ventures, Sequoia Capital, Lightspeed Venture Partners and Accel are arguably the most successful VC funds of the 21st century.

These 5 funds have a whopping $180B of assets under management between them. Since their inception, they have been backing exceptional companies and founders – collectively funding over 1,000 companies each year.

We at Crustdata track all of their portfolio companies and their various growth metrics in real time. We decided to present the funds’ fastest growing portfolio companies and provide other metrics to give you an insight into these companies.

Here are our findings:

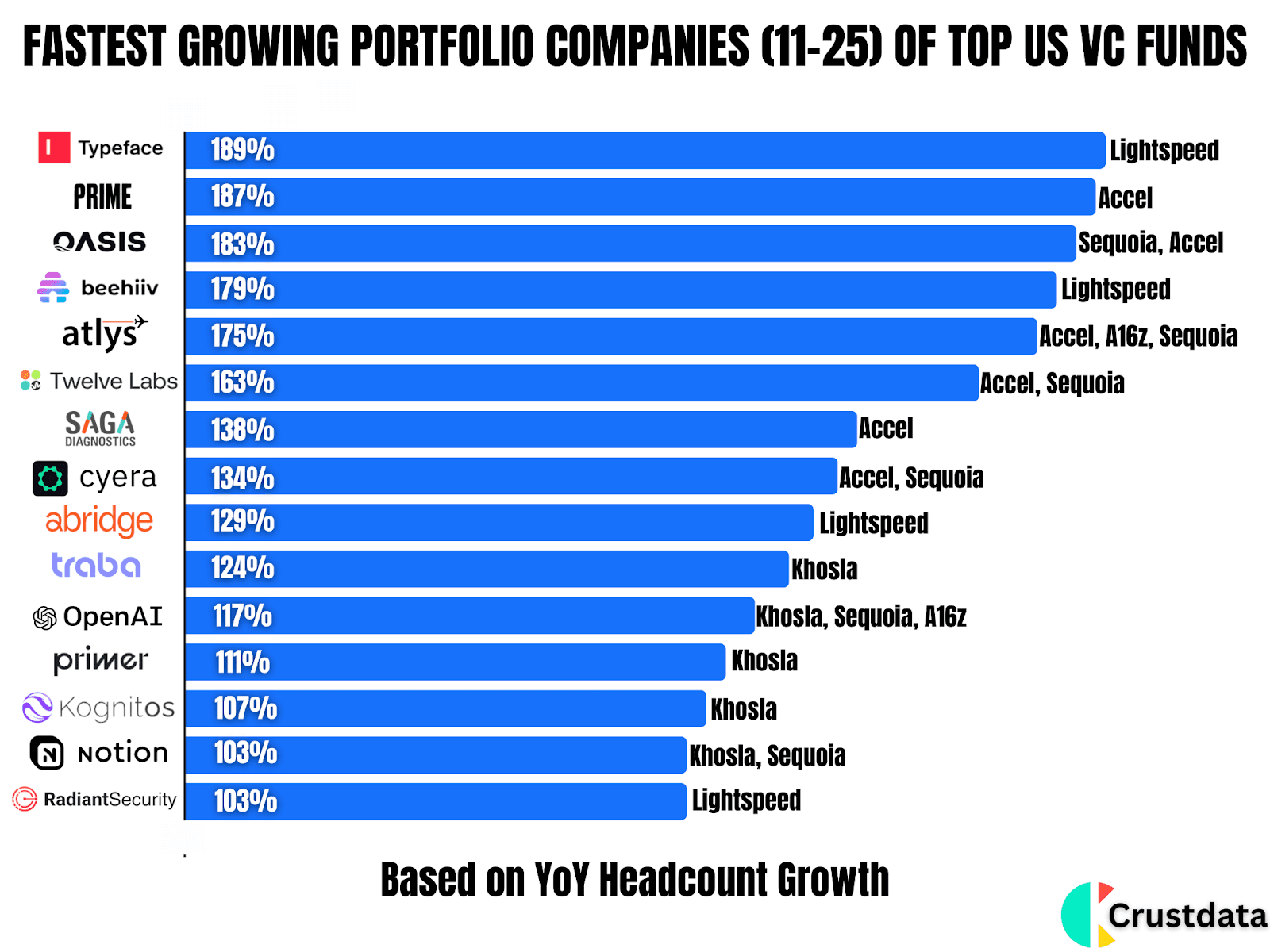

Top 5 Fastest Growing Khosla Ventures Portfolio Companies:

1. Traba (124% YoY) is a marketplace that connects light industrial workers with businesses to fill open shifts by predictive algorithms, machine learning, AI, computer vision and location monitoring.

2. OpenAI (117% YoY) is an AI research and deployment company that conducts research and implements machine learning. Its first and only product ChatGPT has found immense popularity worldwide.

3. Primer (111% YoY) is an online community where 7-14 year olds spend their time coding video games, writing their own books, and exploring nature.

4. Kognitos (107% YoY) is an interactive interface to explore the possibilities of their own minds. It is an AI platform designed to automate business processes.

5. Notion (103%) helps make notes, tasks, wikis, and databases. It serves as a workspace for note-taking, task management, and project management.

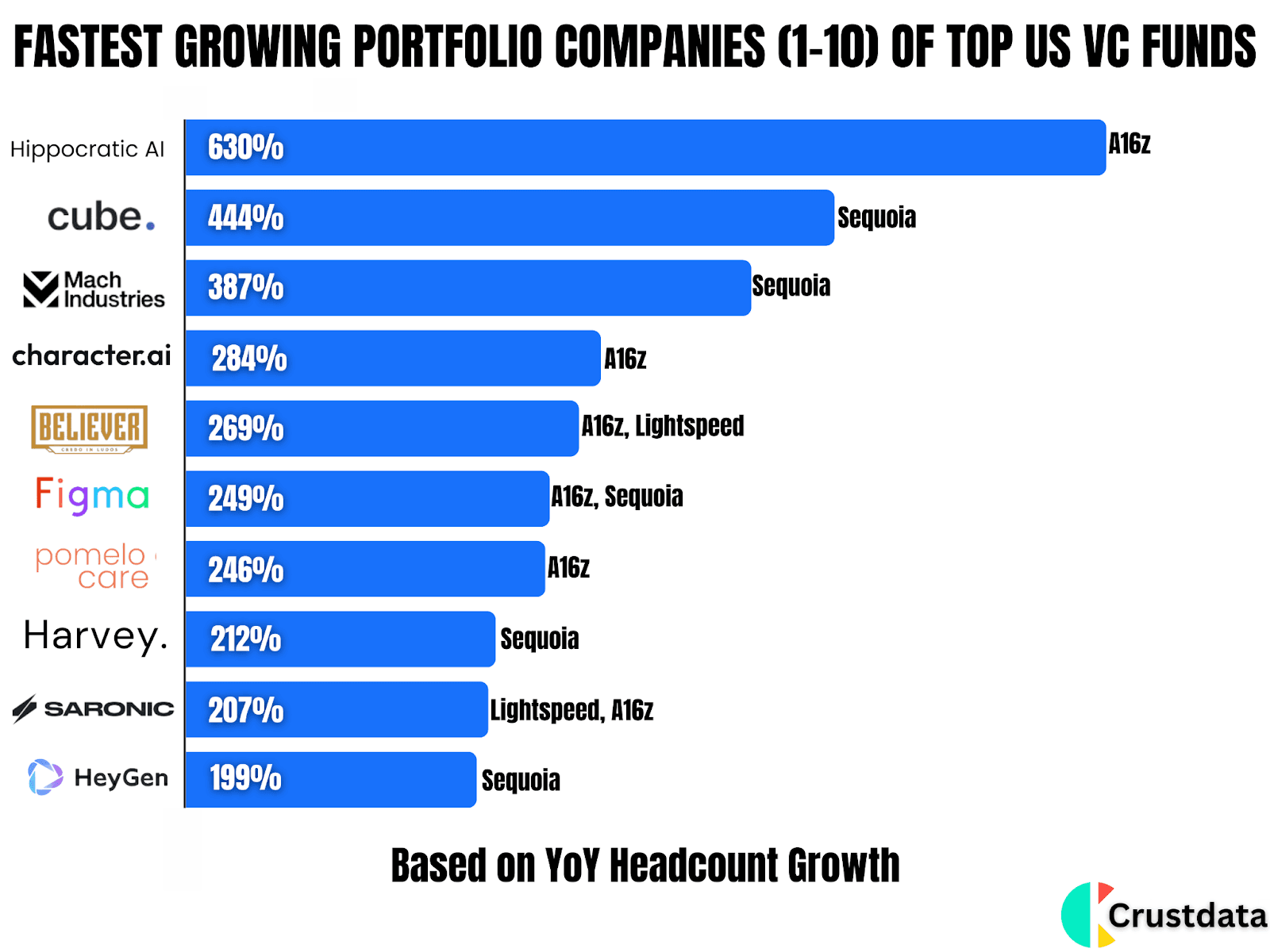

Top 5 Fastest Growing Andreessen Horowitz Portfolio Companies:

1. Hippocratic AI (630% YoY) is developing artificial Health General Intelligence (HGI) to enhance healthcare access and boost the scalability of healthcare professionals.

2. Character.ai (284% YoY) is creating dialog agents by using neural language models with a range of uses in entertainment, instruction, general question-answering and other areas.

3. The Believer Company (269% YoY) is a game development studio that puts the player at the center of their games. It has game developers from all over the world.

4. Figma (249% YoY) is a design platform for teams to build products together. Figma helps product teams create, test and ship designs.

5. Pomelo Care (246% YoY) is a healthcare facility that serves pregnant mothers and babies. Their services include nutrition counseling, treatment for postpartum depression and pediatric care.

Top 5 Fastest Growing Sequoia Capital Portfolio Companies:

1. Cube (444% YoY) is a generative AI startup helping multi-location businesses in online reputation management and customer care by leveraging ChatGPT.

2. Mach Industries (387% YoY) provides technology solutions for defense systems that are built using techniques for producing and combusting hydrogen from sources found in the field.

3. Harvey (212% YoY) is an artificial intelligence technology service provider for knowledge workers. It uses AI to answer legal questions and lands bounties from OpenAI.

4. HeyGen (199% YoY) turns text into realistic spokesperson videos in minutes, from a browser without any cameras or editing.

5. Oasis Security (183% YoY) is a provider of Non-Human Identity Management (NHIM) solutions which is an unresolved security flaw that cyber attackers might exploit.

Top 5 Fastest Growing Lightspeed Venture Partners Portfolio Companies:

1. Saronic (207% YoY) is building unmanned surface vehicles that enable maritime security by combining hardware, software and artificial intelligence into one scalable, integrated platform.

2. Typeface (189%) is a generative AI application for creating enterprise content by combining content velocity with personalization and control.

3. Beehiiv (179% YoY) is a publishing and newsletter platform built for creators. It offers a platform that enables creators to produce and monetize newsletters.

4. Abridge (129% YoY) is a medical conversation AI startup that offers an audio-based system to record and summarize medical conversations.

5. Radiant Security (103% YoY) is an autonomous MDR (Managed detection and response) that automates security operations using machine learning and AI to triage and investigate incidents.

Top 5 Fastest Growing Accel Portfolio Companies:

1. Atlys (175% YoY) offers visas by providing real-time data to avoid last-minute hassles and step-by-step guides.

2. Twelve Labs (163% YoY) is a platform that gives businesses and developers access to multimodal video understanding.

3. SAGA Diagnostics (138% YoY) is a cancer diagnostics and disease monitoring company focused on molecular genetic analyses of a cancer biomarker: circulating tumor DNA (ctDNA).

4. Cyera (134% YoY) is a data security company that gives businesses context on their data, applying continuous controls to assure cyber-resilience and compliance.

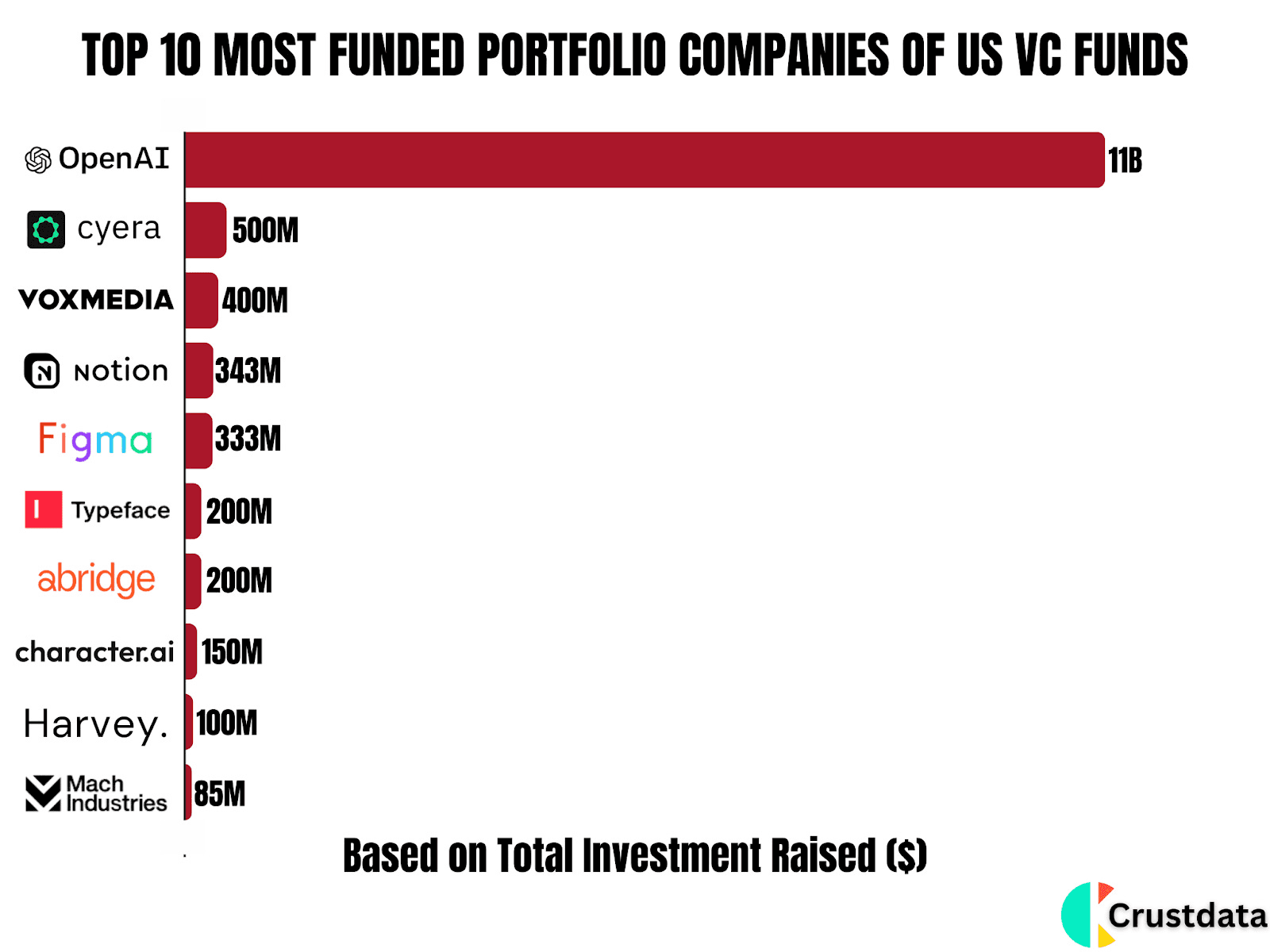

OpenAI tops the charts with a staggering $11B in total investment raised, primarily fueled by Microsoft’s $10B infusion as a part of a corporate round back in 2023.

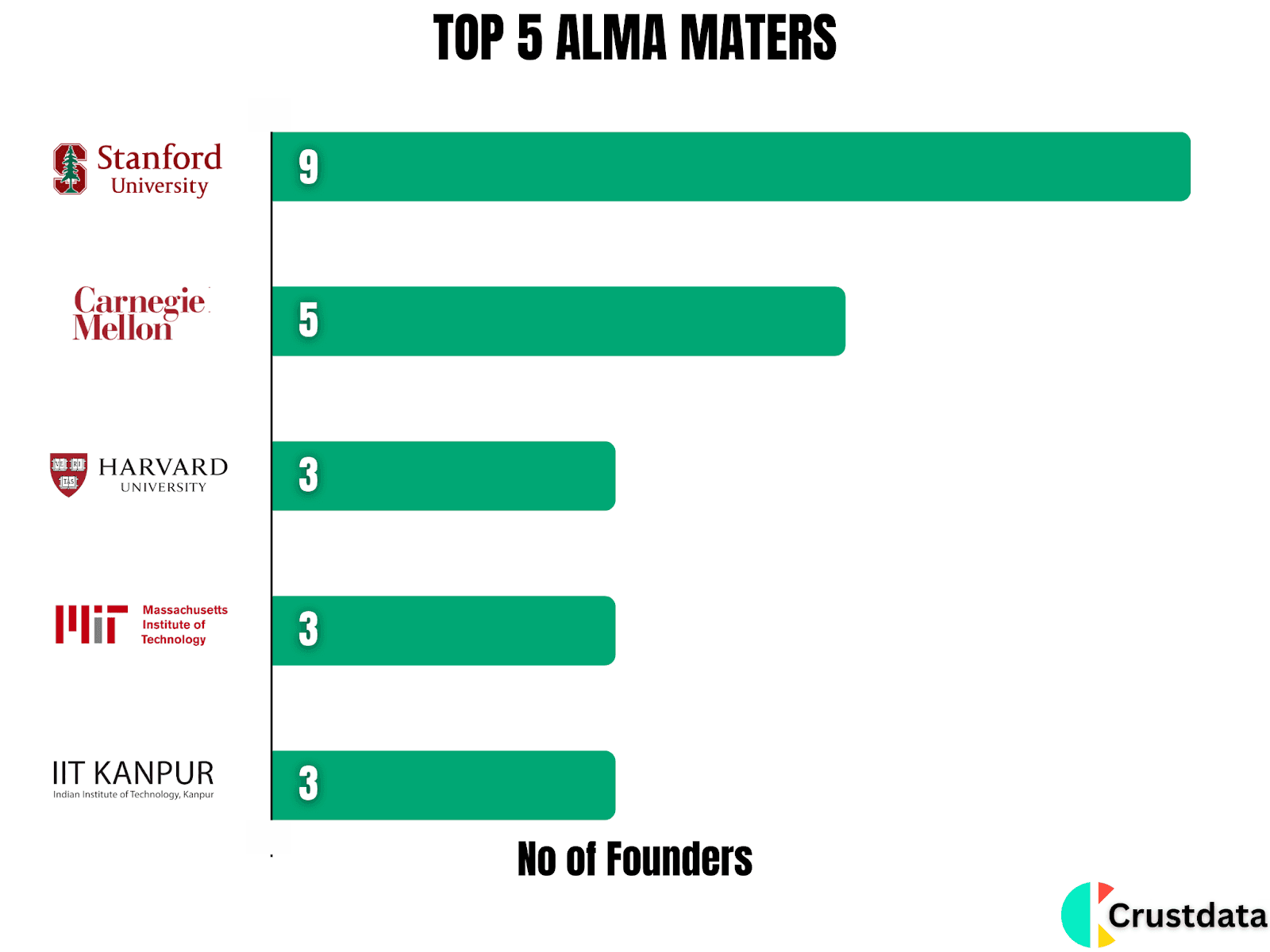

It is no secret that VCs love founders with prestigious college resumes.

Out of the pool of 25 companies and ~50 founders, 18% went to Stanford, 10% went to Carnegie Mellon University and 6% went to Harvard, MIT and IIT Kanpur (a premier engineering institute in India) each.

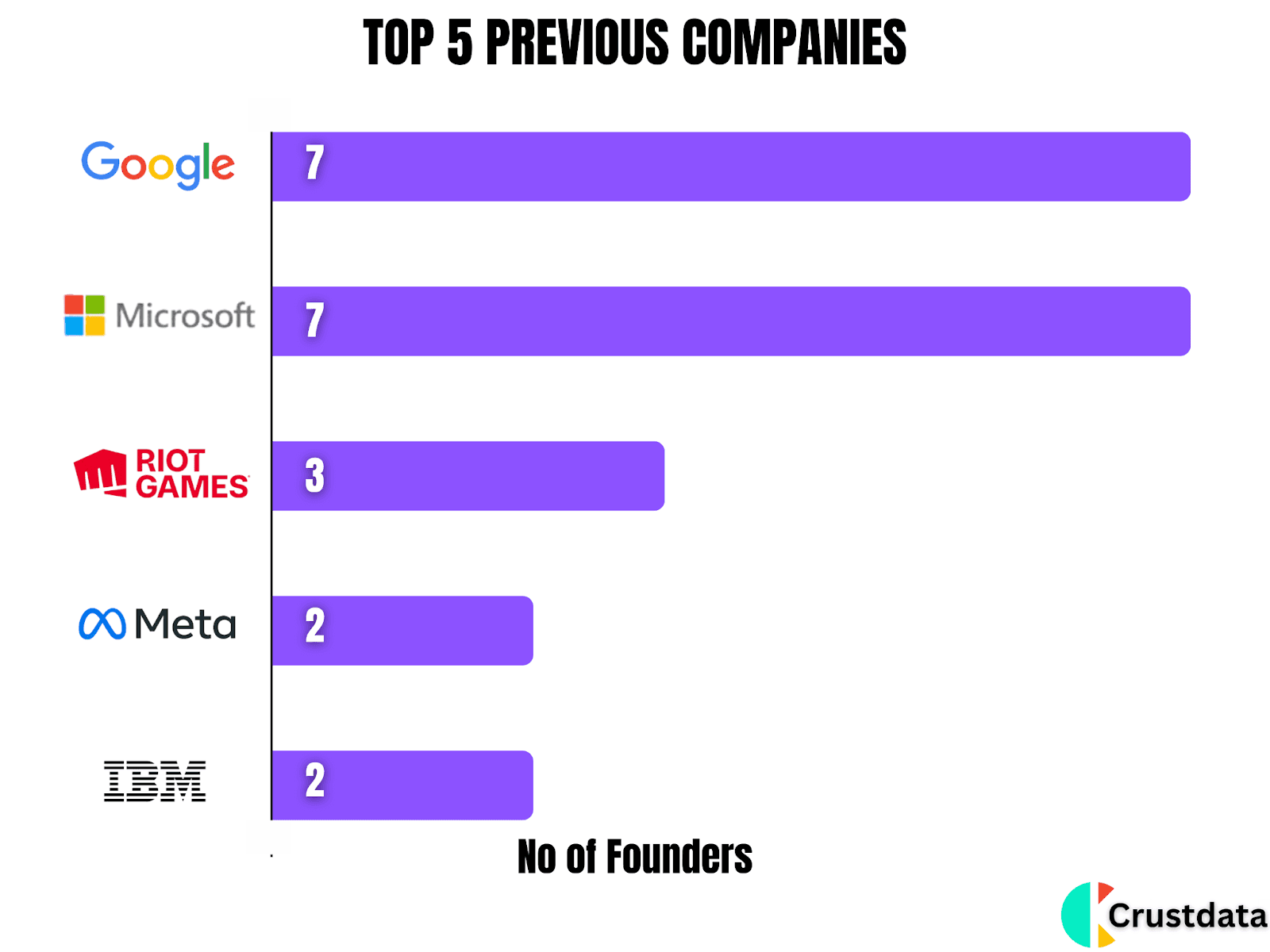

Experience at big tech companies acts as a strong signal for investors as the selection for these companies often serves as a filter for talent.

More than a quarter of the founders have previously worked at either Google or Microsoft! About 6% worked at Riot Games and 4% worked at Meta and IBM each.

Overall this was an interesting cohort to deep dive into – with around 187% Median Yearly Headcount Growth, $14B in collective funding and a bunch of amazing founders with exceptional educational and professional experience.

Experience at big tech companies acts as a strong signal for investors as the selection for these companies often serves as a filter for talent.

More than a quarter of the founders have previously worked at either Google or Microsoft! About 6% worked at Riot Games and 4% worked at Meta and IBM each.

Overall this was an interesting cohort to deep dive into – with around 187% Median Yearly Headcount Growth, $14B in collective funding and a bunch of amazing founders with exceptional educational and professional experience.

About the data

The data seen above is from Crustdata - the most accurate realtime LinkedIn data source for growth and private equity investors. It indexes billions of public data points on companies every week to provide an edge over the private market.